American Rescue Plan: Frequently Asked Questions

On Wednesday, March 10, 2021, Congressional Democrats passed the latest stimulus package. The next day, President Joe Biden signed the American Rescue Plan, H.R. 1319, into law. U.S. Congresswoman Joyce Beatty (OH-03) strongly supported the historic emergency financial relief and investment package to address the unprecedented public health and economic crisis of the COVID-19 Pandemic.

For more information on the historic $1.9 trillion piece of legislation, please see frequently asked questions (FAQs) and answers below.

How much are the Economic Impact Payments (EIPs) and who will get them? When will they arrive?

Under the American Rescue Plan, single filers with incomes up to $75,000, head of household filers with incomes up to $112,500, and joint filers with incomes up to $150,000 will receive payments of $1,400. Those making more than that income threshold will receive lesser amounts, and those single filers making more than $80,000 (head of household filers making $120,000, and joint filers making $160,000) will be ineligible.

If you have direct deposit set up with the IRS, you may have already received the check - if not, you should very shortly. If you receive your tax refunds via check or prepaid debit card, those should arrive in the mail over the next few weeks. For more information, and to check the status of your EIPs, please visit: www.irs.gov/coronavirus/get-my-payment.

Are adult dependents eligible for EIPs?

Unlike previous payments, adult dependents (those who are 19-24, retirees, or adults with disabilities who rely on another person for more than half of their expenses) are now eligible for payments, as long as the filer who claims them as a dependent meets the eligibility requirements listed above.

The check will be sent directly to the filer who claims the dependent, not the dependent.

What tax return year is the government using to determine eligibility for a stimulus check?

Under the American Rescue Plan, the IRS is directed to make payments initially based on a taxpayer's 2019 tax returns or 2020 returns if they've already been filed.

What if I never received my first or second stimulus check?

If you were eligible to receive the first or second stimulus check and didn't receive it, you must claim the Recovery Rebate Credit when you file your 2020 taxes. This form is for paper filers. E-filers should have the option in whatever software they used to file.

Are stimulus checks tax free?

Yes, EIPs are not considered taxable income. Therefore, they will not be taxed and also will not affect your eligibility for any federal government assistance or benefit program.

What's new with the Child Tax Credit (CTC)?

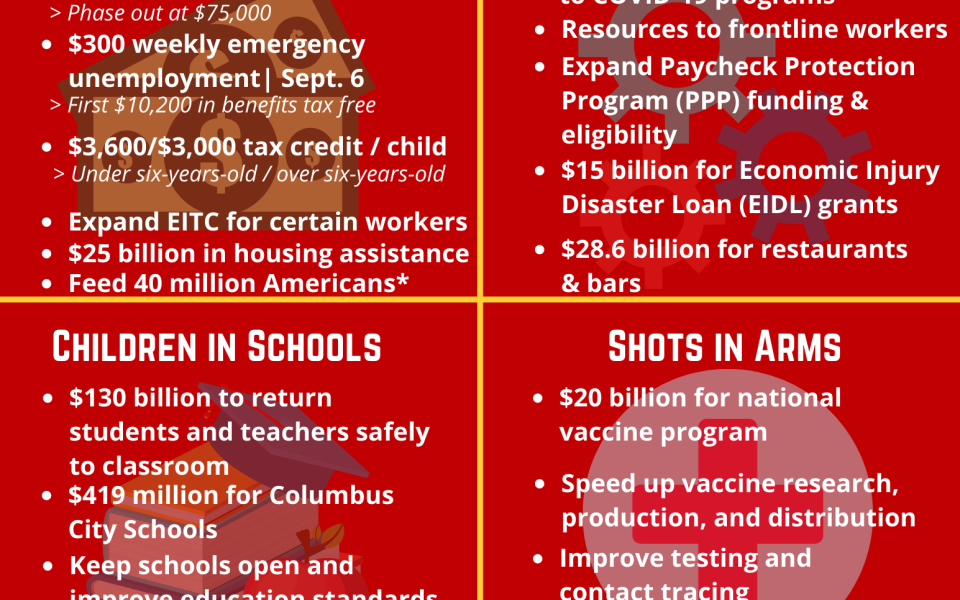

This is one of the most exciting and innovative parts of the bill. In fact, the American Rescue Plan could help cut child poverty in half according to Columbia University. Here's how it works:

If you earns less than $75,000 (or your household earns less than $150,000), you'll receive $3,600 for each child six years old and under; and $3,000 for children between the ages of seven and seventeen. If your income exceeds the earnings threshold, the credit will be reduced by $50 for every additional $1,000 of income. Individuals earning $95,000 or joint filers earning $170,000 are not eligible for the tax credit.

The tax credit applies to your 2021 tax year, but the IRS will advance part of the credit in the forms of checks that will be delivered or direct deposited as early as July. These checks will continue through December. The remaining amount will be credited against your taxes when you file next year.

The child tax credit is available to those living in U.S. territories. It is also entirely fully refundable and doesn't require an individual to be employed to qualify.

If I am expecting a newborn in 2021, are they eligible for a stimulus check?

Yes. The American Rescue Plan includes a provision that allows any person who gives birth in 2021 to receive the third $1,400 stimulus check for that child after filing their tax return in 2022.

Will emergency unemployment be extended? Do I have to pay taxes on my unemployment benefits?

The current $300 weekly emergency unemployment will be extended through early September. The first $10,200 of unemployment received in 2020 is now tax free for households making less than $150,000.

How do I access housing assistance?

If you have been laid off or lost income during the coronavirus pandemic and recession, you might qualify for Emergency Rental Assistance. Ohioans who need assistance should contact their local Community Action Agency. To find your CAA go to: https://oacaa.org/agency-directory/

You may also qualify for protection from the CDC's eviction moratorium. But you need to take action and apply! (Click here for details)

In October, the State of Ohio created the Home Relief Grant program funded by $55 million from the state's federal CARES Act funds to offer assistance to Ohioans who are behind on their rent, mortgage, and/or water bills. The Ohio Development Services Agency (ODSA) later allocated an additional $55.8 million from the state's federal Community Development Block Grant funding to provide assistance into early 2021. In December, Congress approved $25 billion for emergency rental assistance in the new economic stimulus package. These funds will start reaching CAAs that are administering the ERA program in February.

What support does the American Rescue Plan offer to small businesses?

The American Rescue Plan funds $15 billion in Economic Injury Disaster Loans (EIDL) grants, expands Paycheck Protection Program (PPP) eligibility and dedicates an additional $7.25 billion in funding and additional resources to help small and disadvantaged businesses navigate and access COVID relief programs. More information is available here.

The law also specifically increased the funding allocation for a new program at the Small Business Administration (SBA) to offer assistance to restaurants and bars hardest hit by the pandemic from $25 billion to $28.66 billion. $5 billion is set aside specifically for smaller establishments with less than $500,000 in 2019 annual revenue. During the first 21 days, applications from businesses owned and operated by women, communities of color, veterans, or socially and economically disadvantaged individuals will receive priority.

What if a change in my employment status is jeopardizing my health insurance?

If you choose to use COBRA to continue your existing employer-sponsored health coverage, the American Rescue Plan provides a 100 percent subsidy beginning in April through September 2021. For those six months, this subsidy covers all costs associated with COBRA, including the employer contribution. The only exception being individuals who are eligible for other group health coverage or Medicare - they are not eligible for the COBRA subsidy.

Additionally, under the bill, no one will have to pay more than 8.5 percent of their income for a silver plan in the ACA marketplaces. It also provides that individuals150 percent below the poverty level pay no premiums at all compared to 4 percent of their income currently.

Please note, any individual who receives unemployment at any point in 2021 can purchase an ACA silver plan for zero premium.

How will the American Rescue Plan help schools reopen?

The American Rescue Plan makes nearly $130 billion immediately available to State Education Departments, including a projected $441 million for Columbus City Schools, so they can: 1) return children and teachers to the classroom; 2) keep schools open; 3) improve education standards; and 4) support higher education, HeadStart, and childcare.

What's the status of COVID-19 vaccines?

The American Rescue Plan establishes a $20 billion national vaccine program to speed up research, production, and distribution.

In the State of Ohio, Governor Mike DeWine announced on March 16, 2021, another expansion of COVID-19 vaccination eligibility. Under the new expansion, those ages 40 and up and those with five medical conditions will be eligible for the vaccine. He also noted that by March 29th all Ohioans ages 16 and older should be eligible. The expansion will bring in another 1.6 million Ohioans. The new health conditions include cancer, chronic kidney disease, chronic obstructive pulmonary disease, heart disease and obesity.

American Rescue Plan Snapshot